One year back while I was traveling with my boss for a small conference in Delhi. Aditya my boss started telling me about reverse merger of Merck by Schering-Plough, I was surprised to know that as I had a always known that Merck had acquired Schering-plough.....leaving that story apart, in the current scenario if I look into world’s largest pharma Pfizer's current pipeline, it is somewhat dry with its major block buster getting off patented last month, there are not many revolutionary drugs in its somewhat dry pipeline which will give it a huge ROI in next 10 years and it also do not have a strong biopharma presence .....on the other hand the company which is making mark and has been into lot action in biological for a while is Sanofi Aventis of france.........with Sanofi's strong biological pipeline and Pfizer's strength in world class chemical synthesis...in future can we think of a reverse merger of Pfizer by Sanofi ???

Tuesday, December 13, 2011

Thursday, October 27, 2011

China Incorporation!

Happy diwali to all!

Diwali is the festival of lights in India and one of the important festivals for Indian subcontinent.

I have been enrolled for the strategy management course from Indian institute of management- Kozhikode and this December it’s going to come to end, so for our last semester course on Mergers and acquisition we have been assigned a group course and we out of the blue opted for Automobile industry M&A and the classic case we took into account was Geely and Volvo, the merger looked lucrative for Geely's part but when I looked into external environment nation wise the thing which surprised me was government initiatives for more direct investment by major companies in China. We in India had been into development path for long around 30 years but if I compare the two nations in the automobile segment scenario, China is far ahead in terms of price and quality in all the segments (Low price to premium car segments), we so called democratic nation have to learn a lot from the biggest communist nation of the world

Wednesday, July 06, 2011

Eli lilly .....

In US sometime it’s the investor’s who turn around the game for fate of the firm in a given industry, In Pharma from the days of its inception there is lot strong lobby going on which have lead to many decisions in favor of the republican lead lobby such as Biotech drug exclusivity and NDA exclusivity. In India like the Gilead and Pfizer, Eli lilly, Abbott of the world we have Cipla which has replicated the trends in the democracy.

Yesterday I was reading about the article that current CEO of Eli lilly who is veteran for 32 years went against the stake holders opinion of cutting down on R&D budgets , what we have observed over the last decade is that Eli lilly had around 8 blockbuster molecules in its pipeline

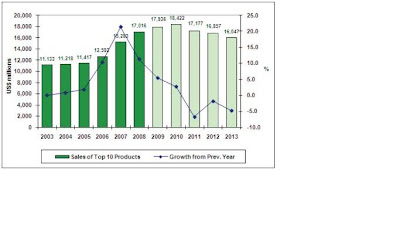

Eli lilly pipeline: One of the Top ten research based companies in the world in terms of sales with block buster products sales exceeding US $1 Billion

Lilly has around compounds Byetta, Cialis, Alimta, and Cymbalta all of which are strong entries to their respective markets. Overall sales is going to rise steadily as mentioned in Epsicom report.

Sales of Major Products (2003A-2013E)

So I second the CEO’s opinion in aspect of allotment of resource for R&D development but also to focus on more licensing deals and mergers and acquisitions in some broad area such as rare diseases and increase in sales in emerging markets

Link: http://www.fiercebiotech.com/story/lilly-outlines-turnaround-strategy-ceo-calls-research-cuts-nuts/2011-06-30

Saturday, June 25, 2011

CMO Outlook in India

Last week I was finishing one assignment for CMO (contract manufacturing organizations) growth opportunities in India and this was in regard to the question put by my prof regarding if you are a company who would like to outsource your manufacturing to India, make a case related to it, there were many points which were favorable for India as destination for outsourcing in term of technology, talent pool which includes reverse engineering experts. the trend which shocked me that many Indian companies are out sourcing there manufacturing to China and then later market their product in India due to cheap labor cost and rapid scale up process. Many north India and west India based companies have implemented this process for long and having an annual CAGR of more than 15%

Sunday, May 29, 2011

One more merger to look

After a long hiatus I am writing my blog, for some months being busy with many things at hand didn't had any time to write my blog so today after lunch of mutton curry and rice thought of writing something.

For many months there have been lot of deals happening in orphan as the major pharma are having a dry sort of pipeline compared to last decade but some like J&J say that they are expecting to have 15 NDA's by 2015, after the major mega deals of 2009 of Merck and Pfizer's of the world i am just awaiting for the biggest mega deal in the European union i.e., of Bayer and Merck Kga, the two conglomerates Merger will be one of the most happening event of the better half of this century.

Tuesday, March 01, 2011

Samsung Diversification........

Samsung electronics is diversifying into bio pharmaceuticals, South Korea’s largest conglomerate is going for joint venture with investment of around $264.4 million, this is a new venture for the firm, for this new venture the tech giant will partner with Quintile’s world's leading clinical research organization which has good experience in biopharmaceutical development, with this JV Samsung tends to produce bio therapeutics for treatment of cancer and arthritis.

Already there are some players which are operating in Biosimilar region from Korea, LG Electronics one of the competitor for Samsung went ahead many years back for biosimilar venture and have been very active since then India, China, Korea and South east Asia, There is still lot to happen in the APAC region in the biosimilar domain, though entry barrier is there, but outsourcing of some processes from the value chain is making it a effective domain for investment.

Already there are some players which are operating in Biosimilar region from Korea, LG Electronics one of the competitor for Samsung went ahead many years back for biosimilar venture and have been very active since then India, China, Korea and South east Asia, There is still lot to happen in the APAC region in the biosimilar domain, though entry barrier is there, but outsourcing of some processes from the value chain is making it a effective domain for investment.

For Samsung JV- Source: http://ca.reuters.com/article/technologyNews/idCATRE71O0F020110225

Tuesday, February 08, 2011

Another Merger...........

Beckman Coulter the name is synonymous to life sciences industry, every one of us who have been a biotechnology graduate would have used their centrifuges as I did in my ME days some six years back and later in my on job research. Yesterday there was announcement that Beckman will be acquired by home grown Denaher which is into pharma diagnostics, dental consumables rest other instrumentation and it is diversifying into the pharma segment with its foot prints specifically in the clinical diagnostics and instrumentation......the deal is estimated to be worth $6.8 Billion......diversification is the mantra for survival of the fittest.

Subscribe to:

Posts (Atom)